what percent is taken out of paycheck for taxes in massachusetts

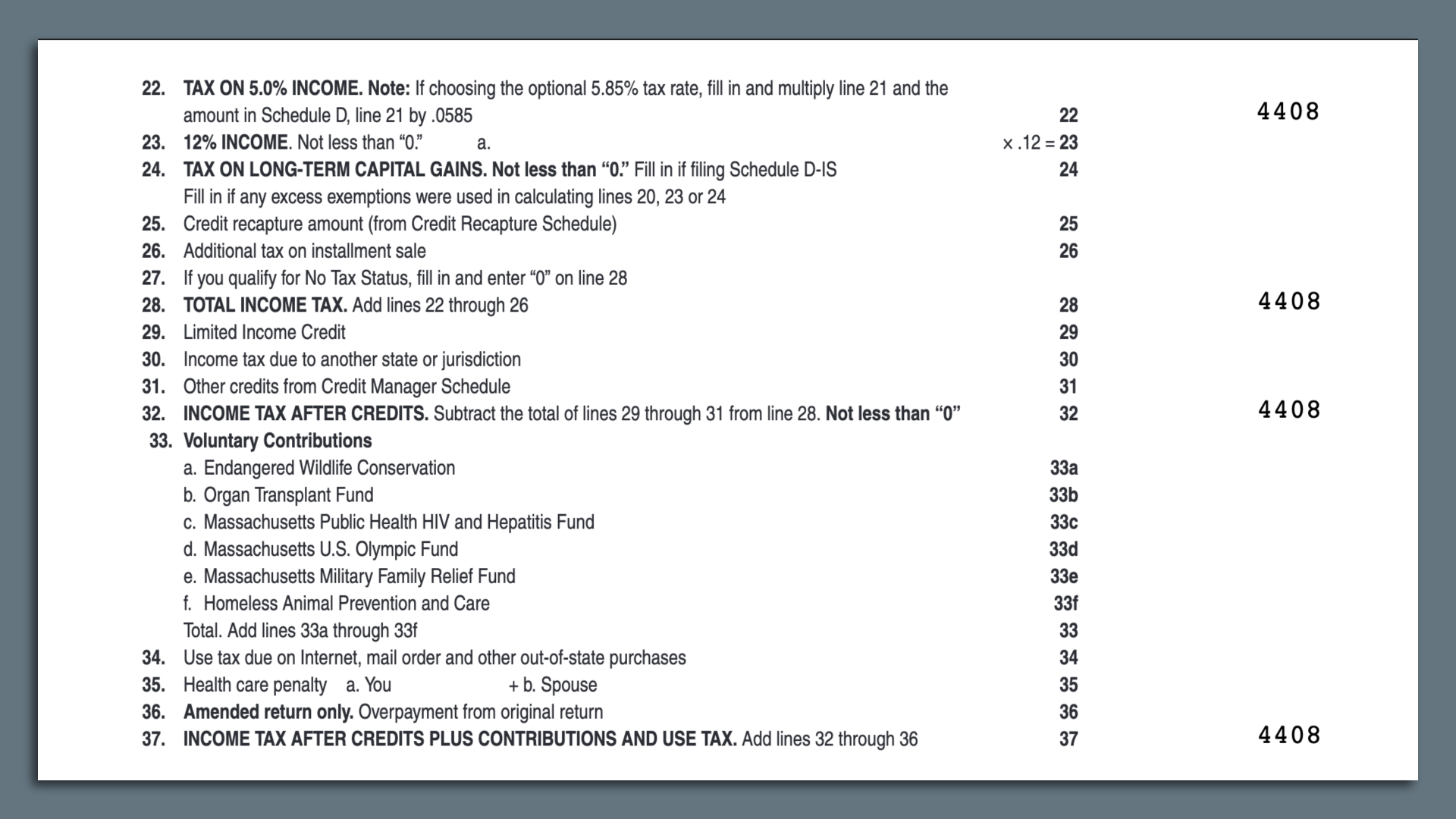

Annually that amounts to. Massachusetts is a flat tax state that charges a tax rate of 500.

How Much Wages Can A Creditor Garnish In Massachusetts Brine Consumer Law

If your income varies then you will need to review the tax tables for.

. This marginal tax rate. However if you expect to owe more than 400 in Massachusetts income tax on the income. Just enter the wages tax withholdings and other information.

No local income tax. 3 rows the income tax is a flat rate of 5. If you selected of Gross enter a percentage number such as 300.

Income taxes in Massachusetts run at a flat rate of 5 for the 2022 tax year which means that regardless of whether your employee makes a hundred dollars or a hundred. Overview of Massachusetts Taxes Massachusetts is a flat tax state that charges a tax rate of 500. That goes for both earned income wages salary commissions and.

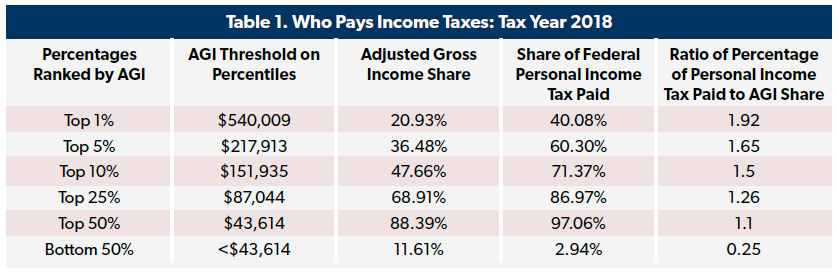

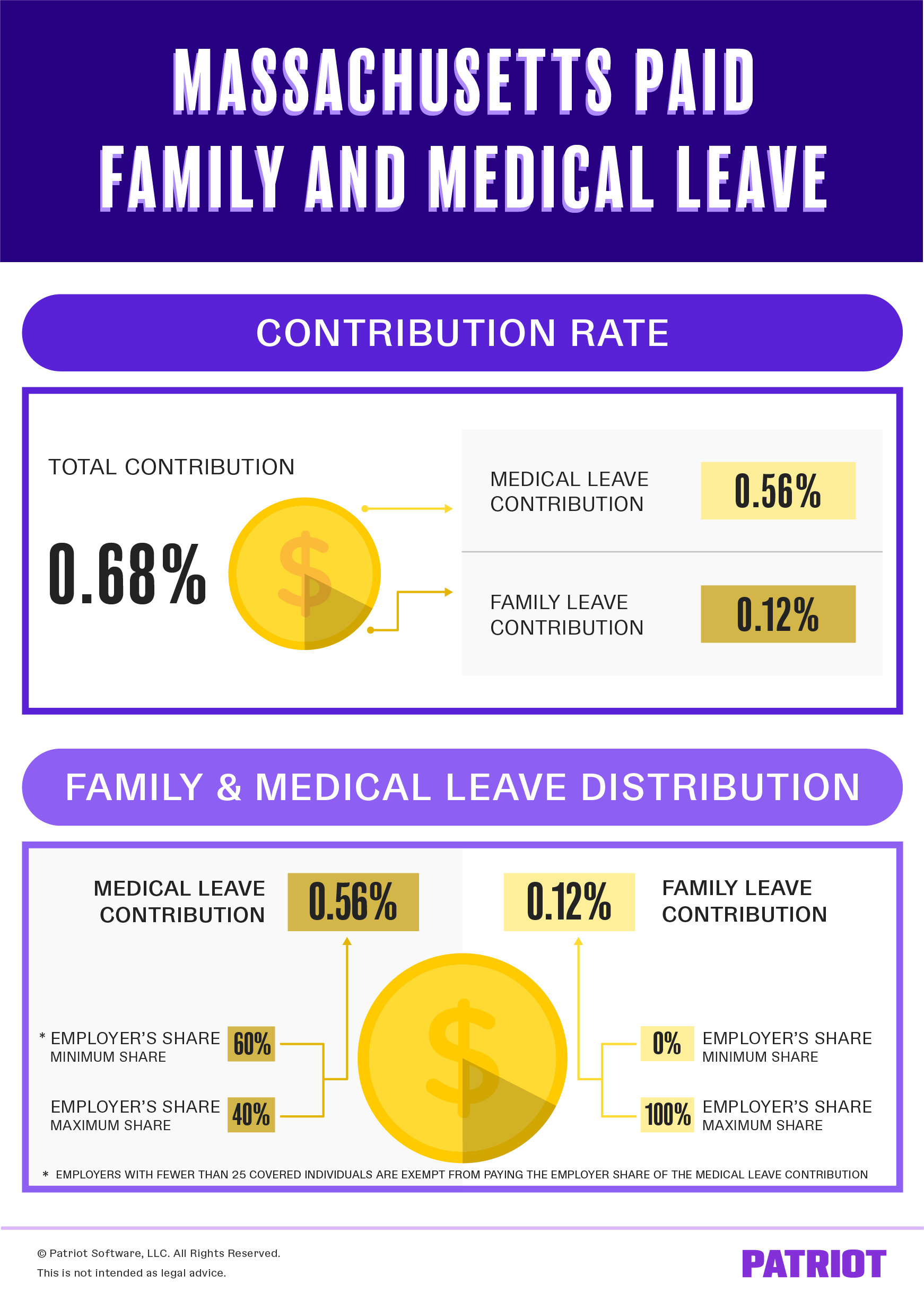

In 2022 if you are a new non-construction business you will. Subject to Paid Family and Medical. Total income taxes paid.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Amount taken out of an average biweekly. That goes for both earned income wages salary commissions and unearned income interest and dividends.

Rates for 2022 are between 094 and 1437 depending on your claims history. This will give you the percentage of tax that should be withheld for state and federal withholding tax. For every 100 you earn a maximum of 38 cents will be deducted for PFML.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. 2 days agoAssuming a top tax rate of 37 heres a look at how much youd take home after taxes in each state and Washington DC if you won the 19 billion jackpot for both the lump. How much is being taken out of my paycheck for PFML.

Multiply the result by 100 to convert it to a percentage. There are seven federal income tax rates in 2022. Therefore you wouldnt register for withholding solely to pay your own taxes.

Amount taken out of an average biweekly paycheck. Your average tax rate is 1198 and your marginal tax rate is 22. If you selected Fixed Amount enter a dollar amount ie.

You do not need to use the percent or dollar sign. Rates are generally determined by legislation. How much income tax do I pay in Massachusetts.

Divide the total of your tax deductions by your total or gross pay. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

The top marginal income tax rate.

The Tax Law For Living In New Hampshire But Working In Massachusetts Sapling

Massachusetts Graduated Income Tax Amendment Details Analysis

Who Pays Income Taxes Foundation National Taxpayers Union

Salary Paycheck Calculator Calculate Net Income Adp

Massachusetts Paycheck Calculator Tax Year 2022

Massachusetts Paid Family Leave Rates Start Dates More

Alabama Hourly Paycheck Calculator Gusto

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

How To Calculate Your Projected Massachusetts Tax Rebate Axios Boston

Payroll For North America Updates State Paid Family And Medical Leave Quest Oracle Community

Wage Deductions Under Massachusetts Law Slnlaw

Massachusetts Paycheck Calculator Smartasset

A Complete Guide To Massachusetts Payroll Taxes

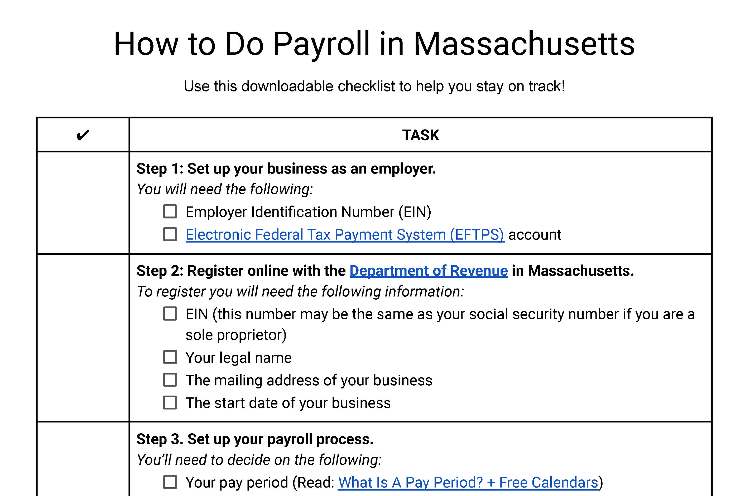

How To Do Payroll In Massachusetts What Every Employer Needs To Know

Payroll Tax Calculator For Employers Gusto

Massachusetts Hourly Paycheck Calculator Gusto

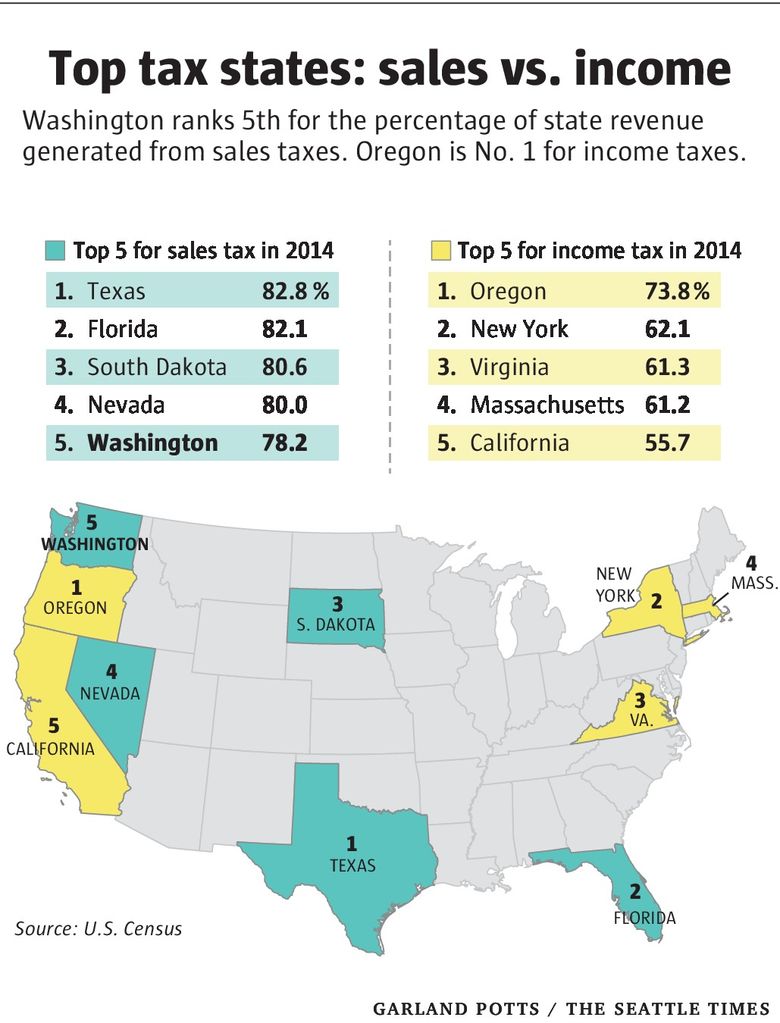

Taxes Like Texas Washington S System Among Nation S Most Unfair The Seattle Times

Free Online Paycheck Calculator Calculate Take Home Pay 2022